The non-Western world is desperately working to unseat the United States dollar, also known as the Federal Reserve note, from being the chief international reserve currency.

Led primarily by Russia and China, efforts to replace the dollar with something else have never been closer to coming to fruition. And once that happens, it is game over for Western dominance over world affairs.

"From diminishing the prevalence of non-dollar transactions to reducing dollar holdings in foreign exchange reserves, states are employing measures to erode the buck’s influence in worldwide trade," reports Andrew Moran for The Epoch Times about how the East is taking steps to unseat the U.S. as the global superpower.

(Related: Last summer, Russian Federation President Vladimir Putin announced that the BRICS countries are actively working on a new global reserve currency to replace the U.S. dollar.)

Will BRICS introduce a multi-currency global financial system to replace dollar dominance?

According to Jim O'Neill, a former chief economist at Goldman Sachs, the BRICS countries, which include not just Russia and China but also Brazil, India, and South Africa, need to expand their presence if they hope to beat the dollar into submission.

"The U.S. dollar plays a far too dominant role in global finance," O'Neill maintains. "Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic."

If the BRICS pact currently in formation continues to grow, there is a good chance that eventually a new multi-currency global financial system will emerge. This would relegate the United States to become just another country in the world order as opposed to the leader of the current one.

Human knowledge is under attack! Governments and powerful corporations are using censorship to wipe out humanity's knowledge base about nutrition, herbs, self-reliance, natural immunity, food production, preparedness and much more. We are preserving human knowledge using AI technology while building the infrastructure of human freedom. Speak freely without censorship at the new decentralized, blockchain-power Brighteon.io. Explore our free, downloadable generative AI tools at Brighteon.AI. Support our efforts to build the infrastructure of human freedom by shopping at HealthRangerStore.com, featuring lab-tested, certified organic, non-GMO foods and nutritional solutions.

Russia seems fully on board with the idea, as its deputy chairman of the state Duma Alexander Babakov spoke openly in favor of it at a recent St. Petersburg International Economic Forum event in New Delhi, India.

"Its composition should be based on inducting new monetary ties established on a strategy that does not defend the U.S.'s dollar or euro, but rather forms a new currency competent of benefiting our shared objectives," Babakov said.

This upcoming summer, South Africa is scheduled to host the 15th annual BRICS summit from August 22-24. There, Putin is likely to expand upon his previous announcement from last year about efforts to create "the international reserve currency based on the basket of currencies of our countries."

"I would like to stress that the Russian strategy does not change: while strengthening our economic, technological and scientific potential, we are ready to openly work with all fair partners on principles of respect to interests of each other, unconditional supremacy of international law, and equality of countries and peoples," Putin said.

There does not need to be an actual currency basket ready right now in order for these countries to compete against the dollar. Over the past year, there have already been numerous instances in which BRICS countries have engaged in cross-country trade using other currencies such as the yuan, the ruble, and others.

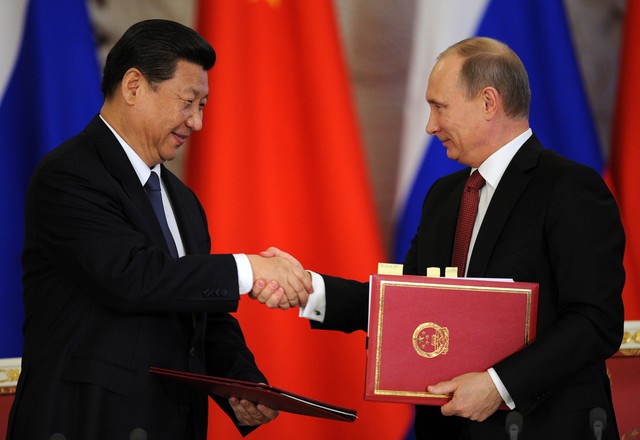

All of this really started to take shape back in May 2014 when China and Russia signed the Agreement on Cooperation, which started the process of BRICS undercutting the dollar's position at the top of the currency mountain. And things have only accelerated on this front ever since Russia invaded Ukraine.

"Before the war broke out, ruble-yuan trade volumes were non-existent," the Times reported. "Since then, however, bilateral ruble-yuan trade volumes have skyrocketed, touching as high as $200 billion at the end of 2022."

More related news coverage can be found at DollarDemise.com.

Sources for this article include:

Please contact us for more information.