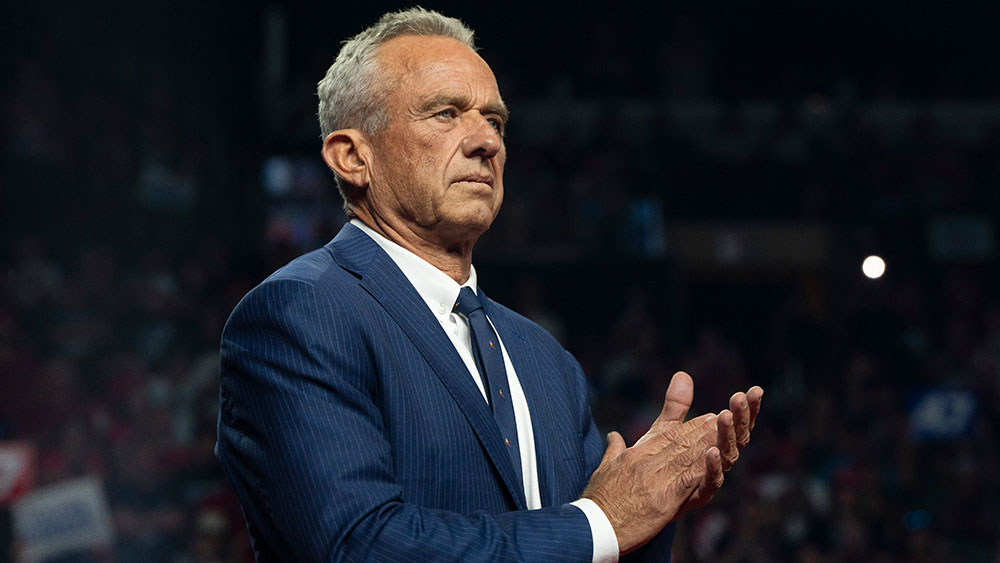

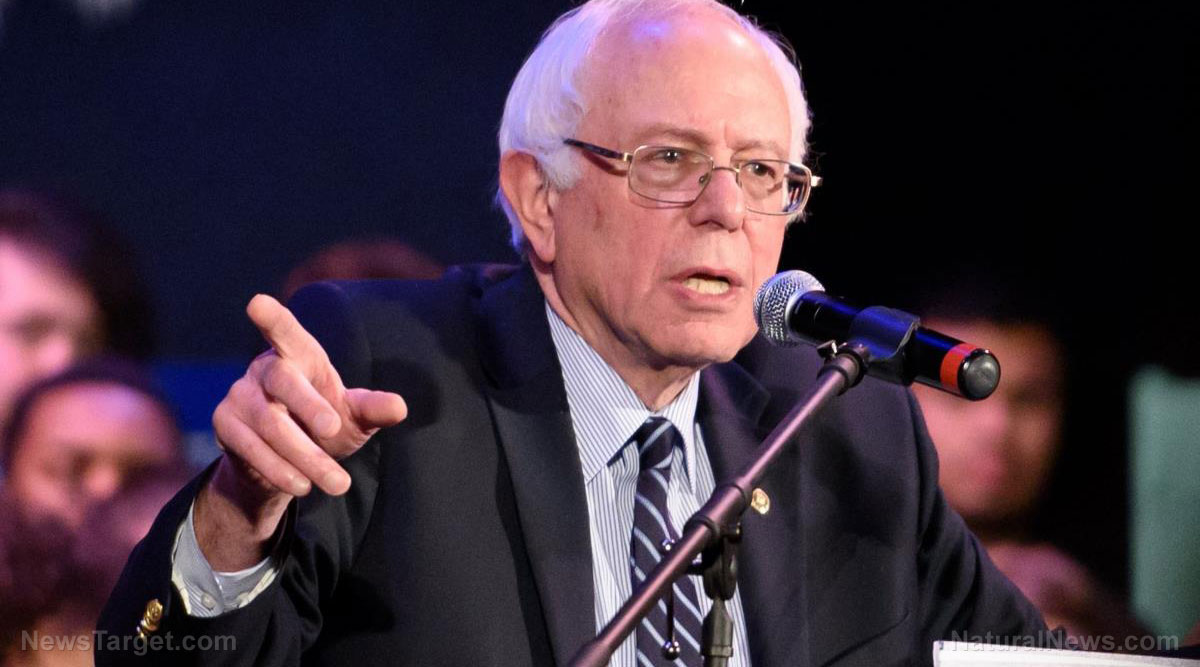

Sens. Bernie Sanders (I-VT) and Jeff Merkley (D-OR), with Reps. Ro Khanna (D-CA.) and Rashida Tlaib (D-MI) recently introduced a new bill that would cancel America's $220 billion in medical debt, eliminate it from credit reports, block creditors from collecting past medical bills and drastically limit the accrual of future medical debt.

According to Sanders, the legislation is as vital for many families' financial security, as millions of Americans struggle with the burden of medical debt. A 2022 investigation indicated that more than 100 million Americans, including 41 percent of adults, hold some kind of healthcare debt.

A KFF Health News analysis also found that those with a disability were more than twice as likely to have medical debt compared with those without a disability. While seven percent of white adults and eight percent of Hispanic adults said they carry medical debt, 13 percent of Black Americans reported having unpaid medical bills. A separate study published in the journal Health Affairs in 2016 also revealed that approximately one-third of cancer survivors had gone into debt as a result of their diagnoses and three percent had filed for bankruptcy.

"This is the United States of America, the richest country in the history of the world. People in our country should not be going bankrupt because they got cancer and could not afford to pay their medical bills," Sanders said. "No one in America should face financial ruin because of the outrageous cost of an unexpected medical emergency or a hospital stay. The time has come to cancel all medical debt and guarantee health care to all as a human right, not a privilege."

If enacted, the Medical Debt Cancellation Act would amend the Fair Debt Collection Practices Act, making it illegal to collect medical debt incurred before the bill’s enactment and creating a private right of action for patients. It would also amend the Fair Consumer Credit Reporting Act which would wipe out medical debt from reports by preventing credit reporting agencies from reporting information related to debt that arose from medical expenses. The proposal would also amend the Public Health Service Act. It provides that the billing and debt collection requirements will be updated to limit the potential for future debt to be incurred. Moreover, the bill would create a grant program within the U.S. Department of Health and Human Services to cancel medical debt, prioritizing low-resource providers and vulnerable populations.

In an interview with the Guardian, Khanna said he had spoken to many Americans bearing the financial brunt of this problem. "I've met people who say they're just resigned to having this debt ruin their credit, and they don't pay it, but they have this kind of harassment and anxiety while they're dealing with a chronic condition like cancer or diabetes," Khanna said.

Analysts predict that it may be difficult for the proposed legislation to pass a Republican-controlled House. However, surveys reflect that the cause gets widespread bipartisan support. According to a YouGov survey conducted in 2022, 66 percent of Americans (56 percent of Republicans and 85 percent of Democrats) support some relief to those with medical debt. "People in America don't think you should go into debt because you go to see a doctor or go to the emergency room," Khanna said. "It's kind of human decency."

The legislation is endorsed by the Center for Economic and Policy Research, Center for Health and Democracy, Center for Popular Democracy, Just Care USA, Public Citizen and Social Security Works.

Bernie Sanders introduces bill to cancel all medical debt.https://t.co/kISCbhLOso

— Citizen Free Press (@CitizenFreePres) May 8, 2024

Medical debt relief doesn’t always work, study reveals

Prior to the Medical Debt Cancellation Act, about 15 state or local governments passed programs in the past two years to acquire about $8 billion worth of medical fees that have either been or are about to be sent to bill collectors. Five others are considering programs that would raise that total to nearly $13 billion. Private donors are also financing the purchase of outstanding medical debts worth billions of dollars at steep discounts. (Related: Connecticut set to become first state to wipe out medical debt for eligible residents.)

Many are looking forward to the passage of Sanders' bill. However, a study of medical debt relief programs released on April 8 as a National Bureau of Economic Research working paper proved that these won't always work. The paper co-authored by Neale Mahoney, a professor of economics at the Stanford School of Humanities and Sciences, found no evidence that buying and then forgiving medical debts that are in collections improved the average beneficiaries' finances, access to credit or their physical or mental health. People were even less likely to pay existing medical bills after their debt was eliminated.

"We are not saying with this study that medical debt relief doesn't help people," Mahoney said. "What we are saying is that trying to help them by reducing their medical debt when it's either in collections or headed there may be happening too late to make a difference or else there are problems with how it is currently done that need to be addressed."

Mahoney added that RIP Medical Debt, the nonprofit organization that partnered with Mahoney and his collaborators on the research and is working with state and local governments on their debt relief plans, is changing its approach, including buying up debts before they reach collections when the hoped-for benefits are more likely to be felt by patients.

"This is what we, as scientists, set out to do, which is to help people in the business of reducing medical debts figure out how to actually have the impact that they want to have," he said. "The overriding question now is, how do we find the sweet spot between low cost and high impact."

Check out DebtBomb.news to read stories related to the burgeoning U.S. debts.

Sources for this article include:

Please contact us for more information.