Advertisement

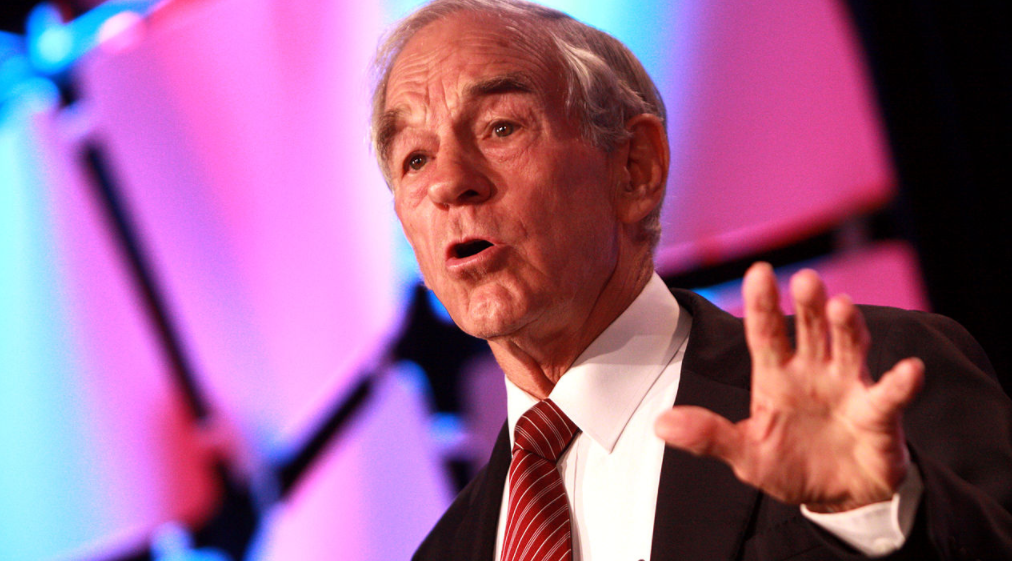

Stock values might be at some of their highest levels ever, but 2012 Republican presidential candidate Ron Paul isn’t convinced that this rally will last. The former Texas congressman told CNBC last week that he wouldn’t be at all surprised if stocks plummeted by as much as 25 percent come October, with a corresponding leap in gold prices by as much as 50 percent.

It’s high time for a market correction, Paul explained during the segment on “Futures Now,” warning that what goes up must come down. Wall Street really isn’t as strong as many people are being led to believe, he contends, and things could turn really ugly in a matter of months.

“If our markets are down 25 percent and gold is up 50 percent, it wouldn’t be a total shock to me,” the libertarian revolutionary commented on the program.

Federal Reserve to blame for wild volatility, Paul says

If all goes as Paul predicts, the S&P 500 Index could drop as low as 1,819 at the same time that gold soars as high as $1,867 an ounce. This would be a great prospect for gold investors who recognize the inherent volatility of fiat currency, of course. But not for folks who are banking high on the prospect of a bullish stock market as they ride the laurels of optimism coming from the Trump administration.

Anyone who’s been following Paul knows that he’s not too keen on the direction that President Trump is taking with regards to the economy. He’s also leery of the private banking cartel that controls the Federal Reserve, as the monetary policies it puts forth – including its longtime practice of keeping interest rates historically low – are setting the stage for major economic disaster.

“I think it’s a very precarious market, and the Fed had better be very careful,” Paul says. “Since they (the banking cartel) are incapable of knowing what to do, I don’t expect much good to come out of anything they do. There are so many mistakes made out there that the correction is almost unlimited.”

Soaring markets a smoke screen as corrections must come, warns Paul

Paul made similar predictions almost a year ago, right before the S&P 500 jumped by 21 percent, and the Dow by 24 percent. During that same time, the tech-dominant Nasdaq reached record highs when it jumped by over 34 percent.

But much of this is an illusion – and one that, no matter how the experts try to spin it, simply can’t go on forever. According to Paul – and traditional Austrian economics – a society built upon debt creation rather than wealth creation will eventually collapse. Governments that endlessly borrow from private central bankers to issue fiat currency on interest will forever be slaves to the money lenders, and that’s exactly what the United States has been doing since 1913.

Paul has long argued in favor of scrapping the Federal Reserve entirely and returning to a system where the Treasury Department issues currency directly, without a usurious middleman. This would end the perpetual debt cycle, get rid of the parasitical central bankers, and restore wealth to the American people.

It’s important to remember that, because fiat currencies like Federal Reserve Notes aren’t backed by anything of actual value, they can be printed endlessly. This creates a cycle of ever-worsening inflation that harms citizens while enriching the banking cartel.

“People have been convinced that everything is wonderful right now and that stocks are going to go up forever,” Paul warns. “I don’t happen to buy this. The old rules always exist, and there’s too much debt and too much mal-investment. The adjustment will have to come.”

Sources for this article include:

Submit a correction >>

This article may contain statements that reflect the opinion of the author

Advertisement

Advertisements