Advertisement

(Freedom.news) Death and taxes are supposed to be the two constants in life for Americans, so the saying goes.

And for the part that is true: We all die of course, and we are all taxed.

But we are not all taxed at the same level.

In fact, when it comes to federal income taxes, a growing percentage of Americans pay none at all. Even worse, a plurality of those Americans still get a tax refund. The question is, why?

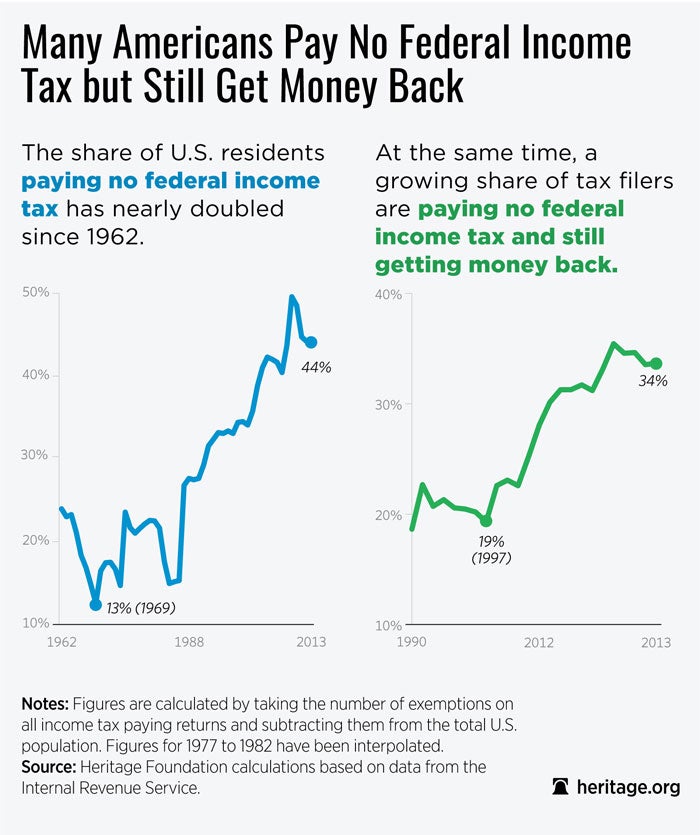

As reported by the Heritage Foundation, the percentage of Americans that don’t pay any federal income tax has risen to 44.2 percent according to just-released figures by the IRS, based on the 2013 tax year (the most recent year data this data is available).

“No doubt many of the non-payers would willingly pay income tax in exchange for the chance to work in a more dynamic economy that generated more and better jobs. But our labor market has been hobbled by government regulations, cronyism, government power grabs, a tax code nobody understands, and federal waste,” Heritage’s Patrick Tyrrell, a research coordinator in The Heritage Foundation’s Center for Data Analysis, writes.

The chart below explains the phenomenon quite well:

Image: Heritage Foundation

It hasn’t always been this way. In 1962, the percentage of Americans who paid no federal income taxes and who were not claimed as dependents by another taxpayer stood at just 24 percent, roughly have of what it is today. By 2009 that figure had risen all the way to 49 percent; it fell 44.7 percent in 2011 and has stayed in the 44-percent neighborhood since.

What’s also true is that progressive [read Marxist] government policies have exploded entitlement programs, and this has especially been the case during the reign of Obama.

“An astounding 33.67 percent of tax returns are filed only to claim benefits while not paying any income tax. That is up from 18.64 percent in 1990,” Tyrrell writes.

At the same time, the government has been collecting a record level of taxes, confiscating more wealth than ever from the American people.

What does this mean? Essentially it means that the more productive members of American society are shouldering more of the burden of paying for government, even as a growing number of Americans become dependent on the government for their survival.

At the same time, in all likelihood as a sop to big donors, Congress has shifted much of the tax burden from corporations, which paid 30 percent of all income taxes in the early 1950s, to productive individuals. Today, according to CNN/Money, corporations only contribute about 11 percent of the total tax haul annually.

Now, we’re not interested in piling on the “tax the corporations!” bandwagon; as it stands, American corporations pay the highest tax rates in the industrialized world as it is (39.1 percent). We get that the tax rules allow corporations to take a lot of deductions, hide profits, etc., but still, it’s not like they’re paying nothing at all.

What is really unfair about the system is the number of tax freeloaders, so to speak – Americans who reap the benefits of those who do contribute to the system but do nothing themselves to contribute as well, even though they’re protected and served by the same government apparatuses.

Successive congresses and presidents long ago figured out they could use the tax code to grant special favors and privileges to certain voting demographics. Now, after a couple of generations of this tax code gerrymandering, there are millions of Americans who actually believe they should have no obligation to help fund the very government from which they demand services.

The tax code was never supposed to be used for this purpose. It was, and was always meant to be, a funding mechanism for government, period – a necessary burden shouldered by all Americans.

Or, at least, more than 56 percent of us.

See also:

Submit a correction >>

Advertisement

Advertisements