- State Farm canceled nearly 72,000 insurance policies in California, including 30,000 homes in the Pacific Palisades region, to avoid "financial failure" due to the increasing frequency and severity of wildfires.

- Multiple wildfires, including the Palisades Fire, Eaton Fire, and Hurst Fire, are burning across Southern California, causing massive destruction, evacuations of at least 70,000 people and a death toll of five.

- The cancellations have left many Pacific Palisades residents without necessary insurance coverage, making it difficult for them to recover from the devastating loss of their homes.

- Due to the exodus of private insurance companies from California, many homeowners are turning to the state's FAIR Plan, a last-resort option for residents in high-risk areas. The FAIR Plan has seen a significant increase in policies, more than doubling between 2020 and 2024.

- The cancellation of policies by insurance providers like State Farm is part of an ongoing trend over the past three years, as the risk of wildfires continues to increase each year.

State Farm has reportedly canceled thousands of policies in the Pacific Palisades region of Los Angeles County just months before deadly wildfires devastated the community.

The Palisades Fire, Eaton Fire and Hurst Fire, are currently burning across Southern California, threatening to cause massive losses for residents who will be forced to rely on their insurers to rebuild. As of Tuesday night, Jan. 7, the Palisades Fire had scorched over 2,900 acres in the Pacific Palisades area, while the Eaton Fire had burned through 1,000 acres near Pasadena and the Hurst Fire had spread across 500 acres near San Fernando. (Related: Wildfires ravage Pacific Palisades, forcing 30,000 to flee as Santa Ana winds fuel uncontained blaze.)

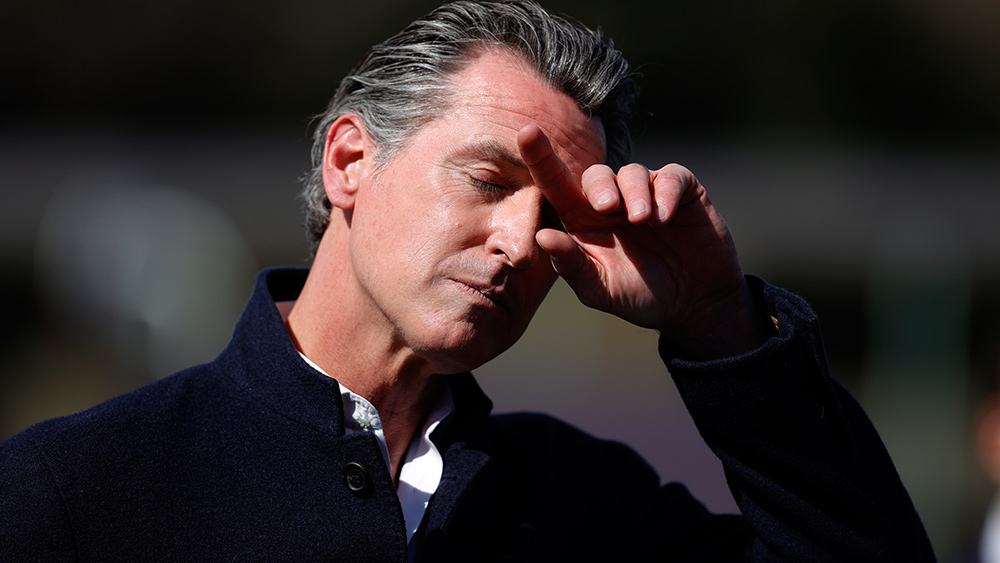

These devastating fires, which have been raging in the Los Angeles area for several days, have already destroyed over 1,000 structures, with the number expected to rise. The fires have caused significant damage and loss of life, with the death toll now at five people. The fires have forced the evacuation of at least 70,000 people, with the number changing as evacuation orders are continually being issued. California Gov. Gavin Newsom has deployed 1,400 fire personnel to help battle the blazes and Oregon is sending 240 firefighters and 60 engines to assist.

All this tragedy happened several months after State Farm cancelled nearly 72,000 policies, including 30,000 homes in the Pacific Palisades region. The insurance provider announced the cancellation in April 2024 to avoid "financial failure" due to the increasing frequency and severity of wildfires in the state.

"As shared with the Department prior to the February 2023 filing, rate increases alone would likely be insufficient to restore SFG's financial strength," State Farm President and CEO Denise Hardin wrote in a letter sent to the Insurance Commissioner Ricardo Lara in March 2024. "We must now take action to reduce our overall exposure to be more commensurate with the capital on hand to cover such exposure, as most insurers in California have already done.

"We have been reluctant to take this step, recognizing how difficult it will be for impacted policyholders, in addition to our independent contractor agents who are small business owners and employers in their local California communities."

Cancellations of private insurance providers leave homeowners with no choice but to turn to FAIR Plan

This decision, which came into effect last summer, affected a total of 1,600 homes in the affluent neighborhood of Pacific Palisades. Many residents in the Pacific Palisades region were left without the necessary coverage to help them recover from the devastating loss of their homes.

The impact of these cancellations has been particularly severe in certain ZIP codes. For example, over 65 percent of policies in ZIP code 95033, located in the Santa Cruz mountains, were canceled last summer, while nearly 48 percent of policies in ZIP code 95409, near Santa Rosa, were also discontinued.

The exodus of insurance companies from California has been ongoing for the past three years as the risk of wildfires continues to increase each year.

This has left many homeowners with no choice but to turn to the state's FAIR Plan, a last-resort option for residents who cannot find coverage from private insurance companies due to being in at-risk areas. The FAIR Plan has seen a significant increase in the number of policies, more than doubling between 2020 and 2024, reaching a total of 452,000, as reported by CapRadio.

Visit Disaster.news for more stories about wildfires and other disasters in the United States.

Watch this clip about the most destructive wildfire in Los Angeles history - the Pacific Palisades fire.

More related stories:

Wildfire plumes worldwide are contributing to ozone pollution and harming air quality.

GRID DOWN: California utility provider cuts power off to thousands amid wildfire threat.

Largest wildfire in Texas burns approximately 1,700 square miles and 500 structures (and counting).

Oregon jury orders PacifiCorp to pay $62 million in damages to homeowners affected by 2020 wildfires.

Sources include:

Please contact us for more information.