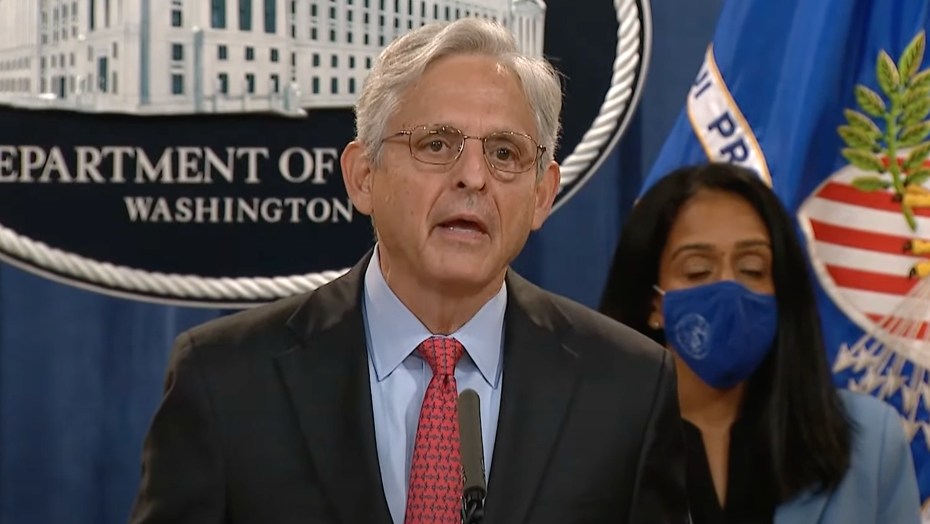

Following the release of the Federal Reserve’s newest meeting minutes, both the S&P 500 and the NASDAQ composite sunk to new lows for the year.

The minutes, which come from the Fed’s September policy meeting, showed that the Federal Reserve plans to raise the federal funds rate, and any possible slowdowns in the pace of rate hikes depend on inflation data that will be released later this week.

Policymakers noted in the Fed’s minutes that inflation is still “unacceptably high.” The three major indexes closed lower for the sixth day in a row in response to the minutes, with the S&P 500 closing 0.3% lower at 3577.03, the Dow Jones industrial average finishing 0.1% lower at 29,210.85, and the NASDAQ composite dropping 0.1% to close at 10,417.10.

Stocks also suffered as a result of September’s Producer Price Index (PPI) release, which indicated that wholesale inflation climbed at a faster-than-expected rate last month. Meanwhile, core PPI – a measure that does not include categories that tend to be volatile, such as energy prices and food – saw its biggest month-over-month increase since May.

The PPI report makes the pending release of the Consumer Price Index even more pressing given the Fed's continued reservations about high inflation.

Morgan Stanley Global Investment Head of Portfolio Construction Mike Loewengart said: "No doubt the Fed still has its work cut out for them, and if tomorrow's CPI read is hot, don’t be surprised to see some investors come to grips with how long the road to tamer inflation may be.”

The central bank issued a third consecutive rate hike of 75 basis points, and the minutes confirmed that the Fed "needed to move to, and then maintain, a more restrictive policy stance" to help address price pressures.

Federal Reserve officials surprised by pace of inflation

Federal Reserve officials are surprised by how persistent the current high inflation has been after members had originally characterized it as a short-term situation. Fed bankers’ expectations came in low last month after consumer inflation reached 8.3% annually in August. Although this was nearly a full percentage point lower than its recent high of 9.1% recorded in June, inflation is still sitting at around 40-year highs.

Some of the meeting’s participants commented that the inflation data was above their expectations and declining slower than they had expected, and they now expect inflation pressures to persist.

Last year, Federal Reserve Chairman Jerome Powell called inflation “transitory,” deeming it a short-term consequence of imbalances in supply and demand resulting from economic shutdowns related to the pandemic. However, in the face of ongoing inflation, Treasury Secretary Janet Yellen admitted earlier in the year that it was wrong to describe it as transitory and that she did not completely understand why it was continuing.

Fed bankers have also implied that unemployment will need to rise before they can move away from steady interest rate increases. There are also concerns that a wage-price spiral could develop.

In a statement to The Hill, Harris Financial Group Financial Advisor Jamie Cox said the Fed could be putting the global economy at risk with its actions. He noted: “The Fed is frustrated that inflation is not responding more quickly to their rapid raise strategy. Which is no surprise, because fed funds increases won’t solve the issues precipitating inflation. Now, the Fed has risked toppling over the global economy, making a bad situation even worse.”

As inflation persists, the markets are currently expecting the Fed to continue raising rates through early 2023.

Sources for this article include:

Please contact us for more information.