The best political advice anyone can follow is to take everything Democrats say and believe just the opposite.

"Inflation Reduction Act?" No; it will increase inflation, according to honest economists (and the Congressional Budget Office).

"We support the Second Amendment," they say, while constantly looking for ways to limit gun rights or attack the gun industry.

"We need 87,000 more IRS agents and staff so we can go after wealthy tax cheats" -- when newly surfaced videos show that in reality, the IRS will be targeting average Americans and small business owners.

As reported by The Western Journal, the IRS is relying, in large part, on college students to recruit many of the new agents and staff, and according to the videos that have surfaced, they aren't going to be looking for high earners.

“In case you thought the IRS needed 87,000 more agents to help you with your tax returns and audit billionaires, watch this: Highlights from the IRS Adrian recruiting project,” Rep. Thomas Massie (R-Ky.) tweeted on Aug. 17.

In case you thought the IRS needed 87,000 more agents to help you with your tax returns and audit billionaires, watch this: Highlights from the IRS Adrian recruiting project.

Link to original video: https://t.co/jgCluHuvvM pic.twitter.com/QXlHmDBR6D

— Thomas Massie (@RepThomasMassie) August 17, 2022

“Notice the scenario in this IRS recruiting program is ‘taking down a landscape business owner who failed to properly report how he paid for his vehicles,’ not ‘taking down a billionaire who uses the corporate jet for private trips,'” Massie added.

The Western Journal noted further:

The recruitment event highlighted in the video took place at Dixie State University in St. George, Utah. It was reported by the university’s Community Education Channel.

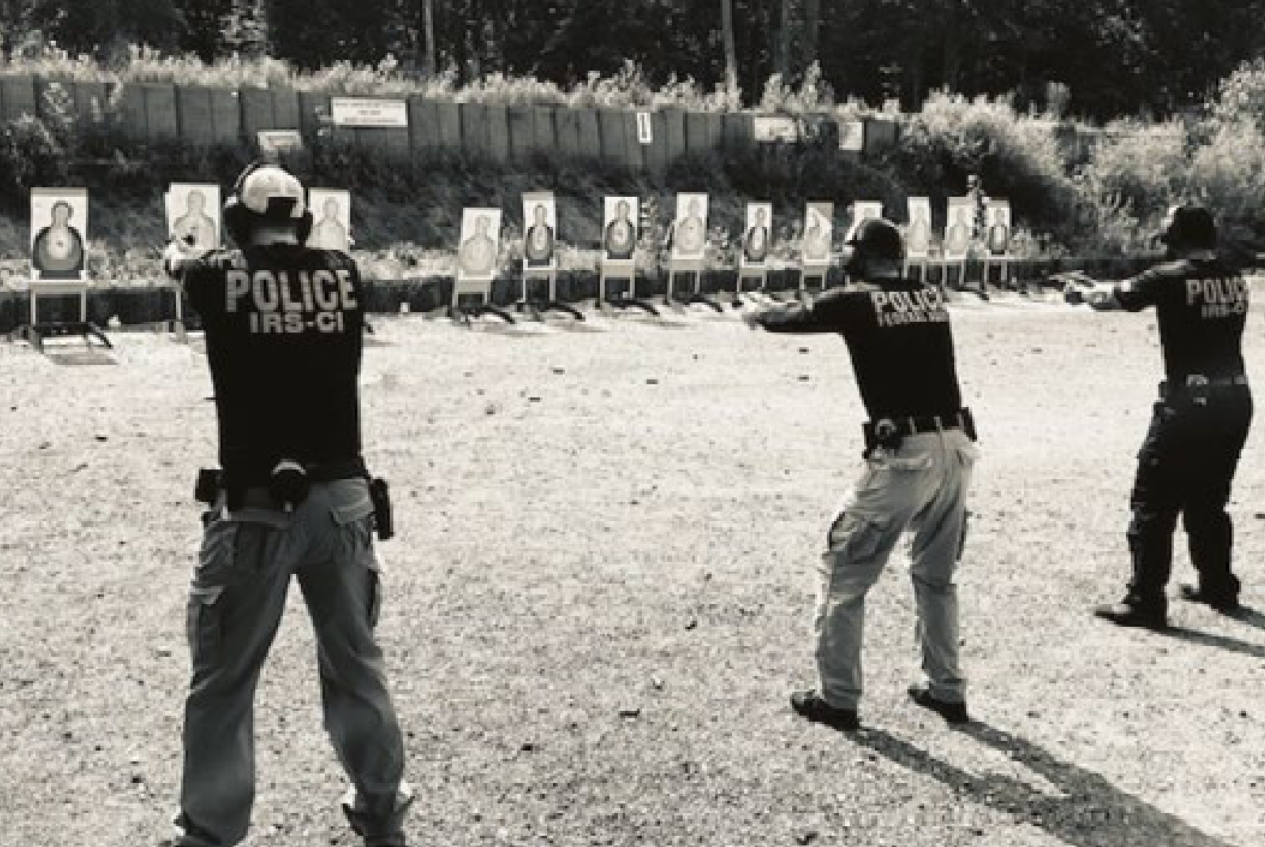

In one exercise, students played armed IRS agents arresting a landscaper wanted for purchasing vehicles with unreported income.

“You’re going to jail, buddy,” one of the students said playfully.

Special agent Elizabeth Lam told the Community Education Channel that IRS criminal investigators “have regular trainings in firearms, building entry” with job duties that include “doing search warrants or making arrests.”

According to the IRS website, the Adrian Project is a recruiting tool that was designed to make it look like working for the agency is rewarding and fulfilling.

“For years, IRS Criminal Investigation field offices have brought the Adrian Project to college and university campuses nationwide,” the site says.

“Classes participate in a day-long simulation of a mock criminal investigation. … Students are ‘sworn in’ as special agents in the morning and wear IRS protective vests, use handcuffs, toy guns and radios to communicate with their counterpart agents on the case," it continues.

“The students sharpen their forensic accounting skills and are introduced to interviewing suspects, conducting surveillance and document analysis. The day ends when the students solve the crime and arrest the mock offender," the site says.

James Lucier, managing director of Washington-based policy research firm Capital Alpha, told the New York Post: “Most small businesses are organized as pass-through entities — LLCs and S Corps. Proponents of increased auditing specifically say they want to target pass-through entities, which inherently means targeting small businesses and small business owners.”

Joe Hinchman, executive vice president at National Taxpayers Union Foundation, added: "The IRS will have to target small and medium businesses because they won’t fight back. We’ve seen this play out before … the IRS says ‘We’re going after the rich’ but when you’re trying to raise that much money, the rich can only get you so far.”

One of the first things Republicans should do when they win back control of Congress and the White House is repeal the law financing this new IRS army that will be used to terrorize ordinary Americans on their first day.

Sources include:

Please contact us for more information.