Americans are becoming increasingly concerned about future surges in inflation. This fear accelerated for the 13th consecutive month in November to a new record high, according to the latest survey published by the Federal Reserve Bank of New York on Monday, December. 13.

Consumers surveyed by the New York Fed said they believe inflation will reach a median of six percent in one year. Last month, they expected inflation to rise by 5.7 percent. (Related: Inflation climbed to 6.8% in November – highest rate in nearly 40 years.)

This is the most worried consumers have been about inflation since this gauge was launched in June 2013.

"Median inflation uncertainty – or the uncertainty expressed regarding future inflation outcomes – increased at both the short- and medium-term horizons, with both reaching new series highs," wrote the New York Fed.

Expectations about year-ahead price changes for rent was at 10 percent. Expectations regarding food and gas price changes were both at 9.2 percent, for medical care it was 9.6 percent and for college education it was 9.1 percent.

Consumers also believe inflation will significantly outpace the growth of their incomes. When asked about their expectations regarding their earnings for the year ahead, consumers only expected it to rise by 2.8 percent, down by 0.2 percentage points compared to last month. The decrease was largest for respondents from households with annual incomes under $50,000.

The households surveyed also believe there is a higher probability they will lose their jobs within the next 12 months. Last month, they believed the probability was at 11 percent. This number has risen to 13 percent. The mean probability of voluntarily leaving one's job in the next 12 months increased from 20 percent to 20.2 percent.

Even if they lose their job, consumers are still fairly optimistic they will be able to find a new job quickly. The mean perceived probability of finding a job if they suddenly become unemployed was at 55.9 percent – a slight decrease from last month's 56.6 percent.

The New York Fed's report, known as the Survey of Consumer Expectations (SCE), is an internet-based survey of a rotating panel of approximately 1,300 household heads.

Fed survey may convince government to curb reckless spending

The SCE plays a critical role in determining how officials in the Federal Reserve will respond to the inflation crisis. The latest survey shows that consumers are very attuned to the state of the economy and are hoping the federal government will figure out a way to combat it.

"When directly asked whether inflation or unemployment was the more serious problem facing the nation, 76 percent selected inflation while just 21 percent selected unemployment," SCE Director Richard Curtin said in a statement.

"This is about well-anchored inflation expectations," said Fed Vice Chairman Richard Clarida during a question-and-answer session at the Cleveland Fed. "Getting actual inflation down close to two percent is going to be an important part of keeping those expectations anchored."

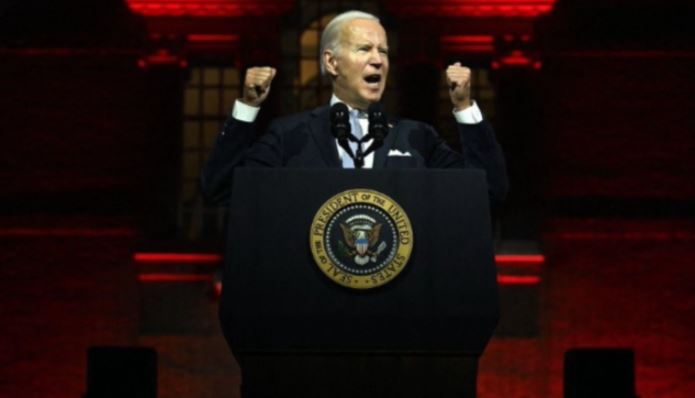

The inflation crisis has been higher and longer-lasting than most policymakers – especially those allied with the administration of President Joe Biden – initially expected. But Fed Chairman Jerome Powell is starting to realize that the government needs to rein in its spending.

He has decided he wants to end the Fed's bond-buying program sooner than planned, which could potentially lead to a faster-than-expected rise in interest rates.

"At this point, the economy is very strong and inflationary pressures are high," said Powell. "It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases – which we actually announced at our November meeting – perhaps a few months sooner."

Watch this episode of "Brighteon Conversations" with the Health Ranger Mike Adams and entrepreneur and conservative political commentator Clay Clark as they talk about how this inflation crisis is a plan conceived by the globalists to collapse the American dollar.

Learn more about the state of America's worsening inflation at Inflation.news.

Sources include:

Please contact us for more information.