People must learn quickly how to complete the necessary preparations to survive stagflation, which is happening right now in the United States.

Stagflation is an economic condition caused by a combination of slow economic growth, high unemployment and rising prices. It last happened in the 1970s as a result of monetary and fiscal policies and an oil embargo. (Related: Joe Biden is proving even more of a 'master of disaster' than Jimmy Carter.)

Brandon Smith of Alt Market said there is lot of things to be done and very little time to counter stagflation. To beat stagflation means to have localized production, decentralization and a move away from reliance on the global supply chain.

Smith, who blamed the Federal Reserve for stagflation, said there is also the need for an institution of local currency systems, perhaps using state banks like the one in North Dakota as a model, barter markets and physical precious metals that rise in value along with inflationary pressures.

He lashed out at the claim of the mainstream media that the Fed saved the U.S. from imminent collapse and that central bankers are heroes. Smith noted that reality isn't a mainstream media story and the U.S. economy isn't the stock market.

"All the Federal Reserve really accomplished was to forge a devil's bargain: Trading one manageable deflationary crisis for at least one (possibly more) highly unmanageable inflationary crises down the road. Central banks kicked the can on the collapse, making it far worse in the process," wrote Smith.

Money printed by Fed used to support banks and corporations around the world

Smith said the U.S. economy is extremely vulnerable because the money created from thin air by the Fed was used to support failing banks and corporations, not just in America but around the world.

"Because the dollar has been the world reserve currency for the better part of the past century, the Fed has been able to print cash with wild abandon and mostly avoid inflationary consequences," noted Smith.

He warned that a massive injection of liquidity will happen if the dollars are to be held overseas in foreign banks and corporate coffers because of its global reserve status.

"There is no such thing as party that goes on forever. Eventually the punch runs out and the lights shut off. If the dollar is devalued too much, whether by endless printing of new money or by relentless inflationary pressures at home, all those overseas dollars will come flooding back into the United States," Smith said. "We are now close to this point of no return."

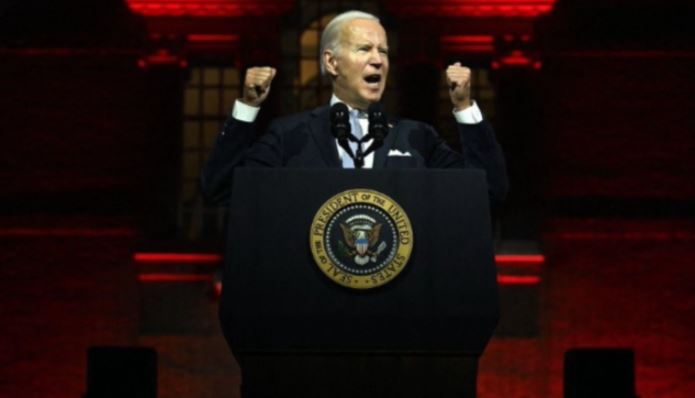

He clarified that President Joe Biden's infrastructure bill and the pandemic stimulus are not the only culprits behind the stagflation event. Rather, stagflation is the culmination of many years of central bank stimulus sabotage and multiple presidents supporting multiple dollar devaluation schemes.

"Biden simply appears to be the president to put the final nail in the coffin of the U.S. economy," wrote Smith, who said the Fed has pumped out approximately $6 trillion more in stimulus and helicopter money through PPP loans and COVID checks.

Biden is also ready to drop another $1 trillion in the span of the next couple years through his recently passed infrastructure bill.

Real crisis happens when inflation becomes visible to public

Smith said the real crisis happens when inflation becomes visible to the public and their pocketbooks take a hit. The Fed must make a choice whether to continue with inflationary programs and risk taking the blame for extreme price increases or taper these programs and risk an implosion of stock markets which have long been artificially inflated by stimulus.

He described the Federal Reserve as an ideological suicide bomber waiting to blow itself up and deliberately derail or destroy the American economy at the right moment.

"Federal Reserve is not a banking institution on a mission to protect American financial interests. The COVID pandemic, lockdowns and supply chain snarls provided the bankers the cover events to hide their calculated economic attack, otherwise the would take full blame for the disaster," Smith said.

If inflation becomes rampant, the Federal Reserve may be compelled to raise the interest rates in a short span of time, which will result to immediate slowdown in the flow of overnight loans to major banks, an immediate slowdown in loans to large and small businesses, an immediate crash in credit options for consumers and an overall crash in consumer spending.

"This recipe created the the 1981-1982 recession, the third-worst in the 20th century," noted Smith. In other words, the choice is stagflation, or deflationary depression, and it would appear that the Fed has chosen stagflation. We have now reached the stage of the game in which stagflation is becoming a household term, and it's only going to get worse from here on."

According to official consumer price index (CPI) calculations and Fed data, the U.S. is now witnessing the largest inflation surge in over 30 years – but the real story is much more concerning.

Smith said CPI numbers are manipulated – and have been since the 1990s when calculation methods were changed and certain unsavory factors were removed.

"If we look at inflation according to the original way of calculation, it is actually double that reported by the government today. In particular, necessities like food, housing and energy have exploded in price, but we are only at the beginning," said Smith, who stressed that price spikes in necessities like housing and food will generate mass poverty and homelessness.

Follow Bubble.news for more news related to the stock market and the economy.

Sources include:

Please contact us for more information.