Some of America’s top-selling motor vehicles are being made without computer components in 2021. Ford Motor Company is holding Ford-150 pickup trucks in the factories as long as possible as they wait on computer chips to become available. The new trucks will not arrive at the dealerships on schedule due to the worldwide shortage of semiconductors.

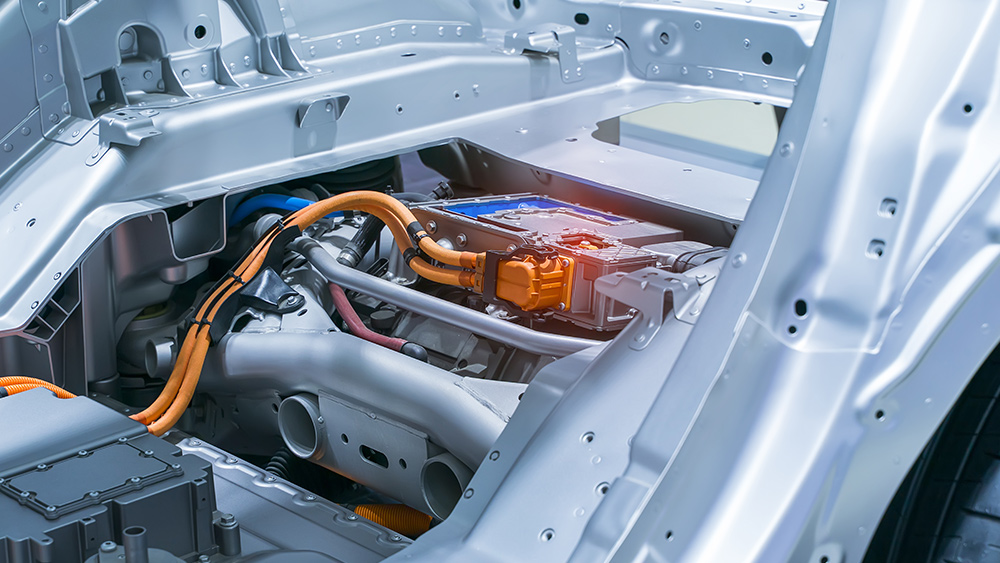

New vehicles are made with multiple silicon chips. These chips are incorporated into many aspects of the vehicle, from the power steering to the brake sensors, to battery systems, entertainment systems, and backup cameras. As the industry transitions to more electric vehicles, more semiconductor chips are needed to make the vehicles work.

Semiconductor shortage affecting the entire automobile industry

The Ford plant in Louisville, Kentucky is canceling shifts on Thursdays and Fridays because they do not have enough computer equipment to build the latest model of the Ford Escape SUV. Ford had to shut down a German factory for an entire month, laying off thousands of workers and halting production of the Ford Focus. The shortage is expected to cut Ford’s pretax earnings by upwards of $2.5 billion in 2021. The automobile industry was already struggling from the shutdowns of 2020.

The semiconductor shortage is also affecting General Motors, Nissan, Volkswagen, Fiat Chrysler, Honda, and Toyota – all of which are struggling with production. General Motors is building new pickups, but some of the computer equipment is scheduled for installation at a later date. Volkswagen and Fiat Chrysler are consolidating production lines for specific models to meet consumer demand for their most popular models. Volkswagen is already slashing 100,000 vehicles from production in the North American, Chinese, and European markets.

Nissan is currently shutting down factories in Smyrna, Tennessee and Canton, Mississippi, as they face a computer chip shortage. The Nissan plant in Aguascalientes, Mexico shut down for a week. Countless Nissan models, including the Murano, Rogue, Maxima, Leaf, Altima, NV Vans, Kicks, Versa, and March won’t make it to the dealerships on time.

Computer chips reserved for household electronics, not automobiles

The demand for personal electronics has skyrocketed over the past year as consumers bought up computers, TVs, and gaming systems in record numbers to cope with the lockdowns. From start to finish, a chip can take 26 weeks to complete.

Semiconductor companies have prioritized consumer electronics over automobile electronics over the past year, as schools turned to virtual learning and as businesses and healthcare systems relied on virtual communications. Companies like Apple and HP receive higher priority for semiconductor chips because they pay more for the chips, starting at the silicon foundries. Two of the world’s largest car parts suppliers, Bosch and Continental, are receiving “significantly fewer” chips, as the computer and gaming industry receives top priority. Continental reports a six-to-nine-month lead time for the silicon chips.

Hermann Hauser, who helped create the British chip designer Arm, said the automobile industry pays less for the chips and is suffering as a result. “When the chip industry decides should we allocate our capacity to the car industry or the telecoms industry or the server industry, it’s an easy decision,” he said. “Go for the server industry because their gross margins are so much better. That’s why the car industry is in a particularly tight spot.”

The automobile industry is becoming increasingly dependent on semiconductor chips, as the industry transitions to more electric vehicles, self-driving cars, user interface and battery-powered systems. Perhaps Ford or General Motors should consider developing a new line of vehicles that are basic, without all the computers and electronics.

Sources include:

Please contact us for more information.