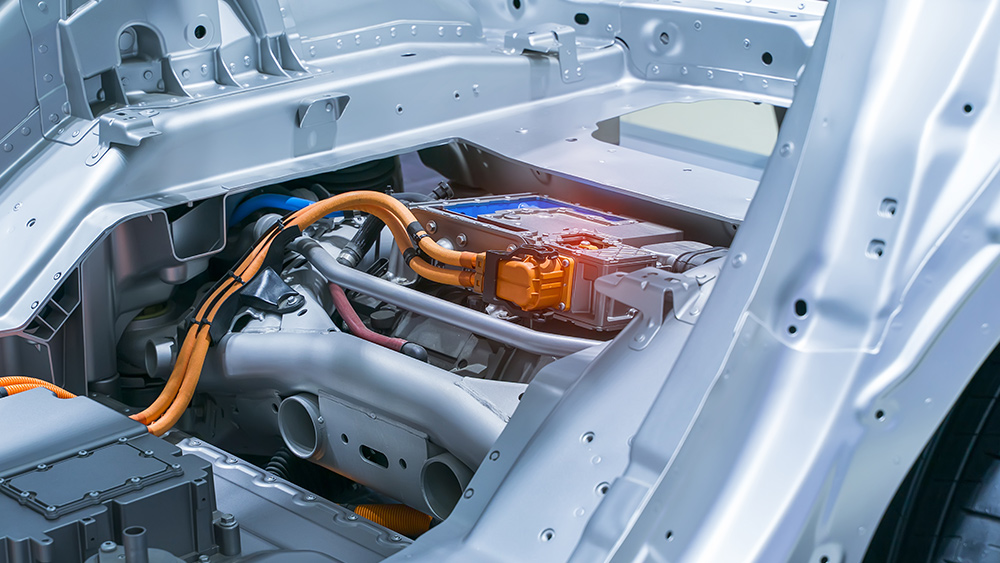

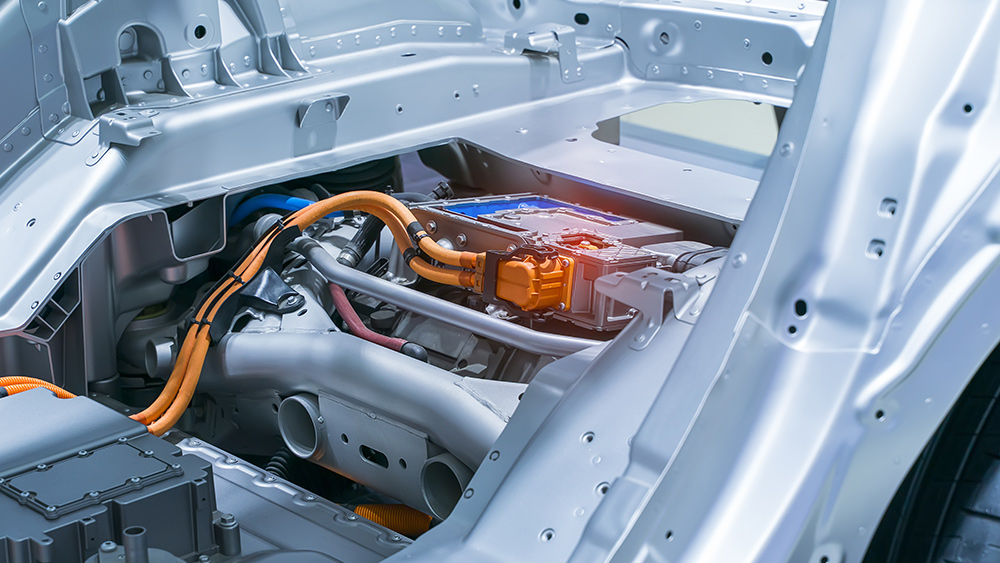

Electric automaker Tesla has agreed to buy nickel from mine in New Caledonia, in the southwest Pacific Ocean, to secure its supply of the key battery metal.

The deal amid growing concern over future supplies of the metal. This is after a 26 percent rally in nickel prices over the past year and growing investment by Chinese companies in Indonesia.

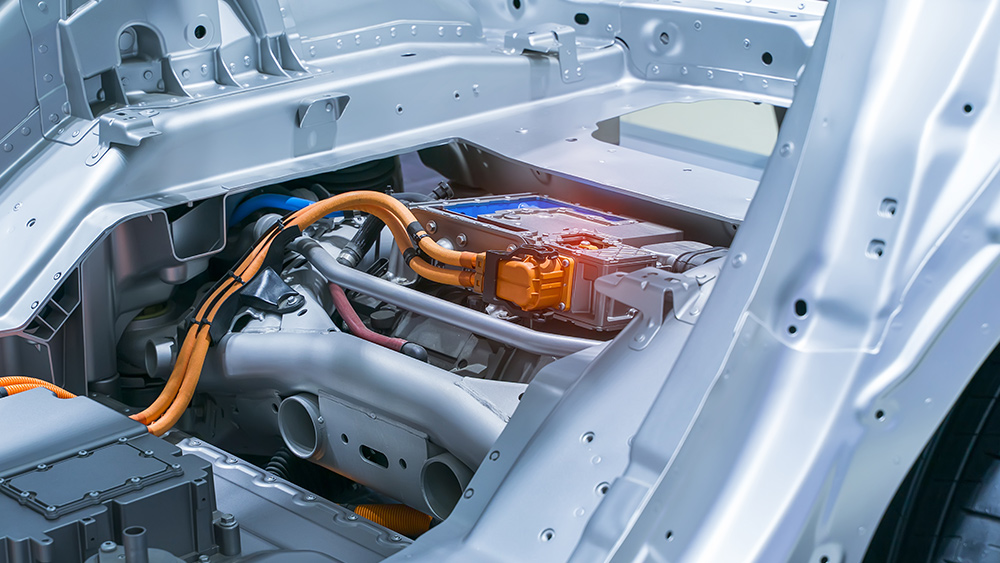

The metal is a key component of lithium-ion batteries used in electric vehicles. As such, it has been labeled by Tesla chief executive Elon Musk as the company's "biggest concern."

“Nickel is our biggest concern for scaling lithium-ion cell production,” Musk said on Twitter.

Agreement comes after long-delayed sale

On Thursday, March 4, political leaders in New Caledonia agreed to the terms of the sale of the mine, which had been owned and operated by Brazilian mining company Vale SA. This included a majority stakeholding for local interests that sought to resolve unrest over the planned sale.

New Caledonia is one of the largest nickel producers, but protests in December by groups seeking independence from France delayed the sale of the mine and accompanying refinery to a consortium that included Swiss commodities trader Trafigura.

The protests, which turned violent, let to Vale shutting down the site that month.

Under the new agreement, a 51 percent stake in the mining operation will be held by New Caledonia's provincial authorities and other local interests. On the other hand, Trafigura will have a 19 percent stake – less than the 25 percent it initially wanted.

As part of this, Tesla will act as an industrial partner that will help with product and sustainability standards while taking some supply for its battery production.

All parties involved also called for reinforced environmental standards and set a 1030 target for the mining complex to achieve carbon neutrality.

Tesla looking for more control over its nickel supply to beat the Chinese

Tesla will not have an equity stake in the mine, but its close involvement signals its efforts to have greater control over its supply chain. Last year, Tesla entered into a similar deal to buy cobalt, another battery metal, from Swiss miner Glencore.

Nickel is mined mostly in Russia, Canada, Indonesia and New Caledonia. While it is primarily used to make stainless steel, growth in the electric vehicle segment has increased demand for it for use in batteries. (Related: Can magnesium batteries revolutionize battery technology?)

While a number of companies, including Chinese companies, have invested in nickel projects in Indonesia over the past few years, the process to extract and process the metal uses energy from coal-fire power. The latter means that nickel from those mines may not meet Tesla's environmental standard.

"The only incremental nickel tonnage is coming from Indonesia but the problem with Indonesia from an ESG perspective is it may not meet the criteria of Tesla," said Jim Lennon, an analyst at Macquarie.

In addition, Lennon remarks that Tesla is behind the Chinese when it comes to securing nickel supplies.

"Tesla is way behind in securing units and the Chinese have wrapped it up."

On March 2, Tuesday, Chinese stainless steel producer Tsingshan announced that it had signed an agreement to sell 100,000 tons of nickel to two Chinese battery makers, Huayou Cobalt and CNGR Advanced Material.

Tshinshan stated that it had begun producing higher purity nickel – a form suitable for electric-vehicle batteries – at its Indonesia plant.

For more news on Tesla and other companies owned by Elon Musk, follow ElonMuskWatch.com.

Sources include:

Please contact us for more information.