When we first learned about former WeWork CEO Adam Neumann's practice of buying commercial properties (or shares in said properties), and then leasing them back to WeWork (often at an inflated rate), we knew that if Neumann had gotten away with such blatant self-dealing without a peep from the board, then WeWork's governance problems were probably far more extensive than the public realized at the time (this is roughly one year before WeWork's vision of a future powered by "We" came crashing down as the IPO was scrapped).

(Article by Tyler Durden republished from ZeroHedge.com)

But here we are, more than a year later, and the proper authorities are finally getting involved. According to Reuters, New York State AG Letitia James is investigating the company and its former CEO. Specifically, investigators are looking into whether Neumann engaged in illegal self-dealing.

Did he? Well, Neumann had no qualms about enriching himself by using his company as a backstop for his personal investments, leveraging WeWork's power as a lessor to worm his way into deals by touting his ability to bring on an anchor tenant willing to pay above-market rates. Neumann also personally bought the trademark to the word "We", then charged his company $6 million to transfer the trademark (he later returned the money). When it came time to prepare the original WeWork pre-IPO prospectus, Neumann came up with an ownership structure that, as he put it, would leave his family in charge of WeWork for "the next 300 years" as he once reportedly bragged.

And when it all came crashing down, and WeWork's valuation plunged to under $10 billion from north of $55 billion in the span of a few weeks, SoftBank, WeWork's most fervent backer, was forced to either accept a massive loss, or put up more money for a turnaround.

When the buyout came, Neumann still walked away with a $1.7 billion payday. He's off enjoying early retirement while a SoftBank-installed management team is desperately trying to figure out how to stave off bankruptcy at WeWork.

The company is now facing a radical restructuring: Some 4,000 employees, roughly one-third of WeWork's global workforce, will likely be laid off before the end of the week. Employees who don't support WeWork's core mission will be let go, while the rest will learn on Friday what their new roles will be. Executive Chairman Marcelo Claure, a SoftBank exec, has been installed at the top to try and lead the WeWork turnaround.

Unfortunately for Neumann, federal authorities also seem to have taken an interest. The Reuters report followed a trial balloon published by Bloomberg claiming the SEC was looking into whether WeWork violated financial rules as it pursued its public listing.

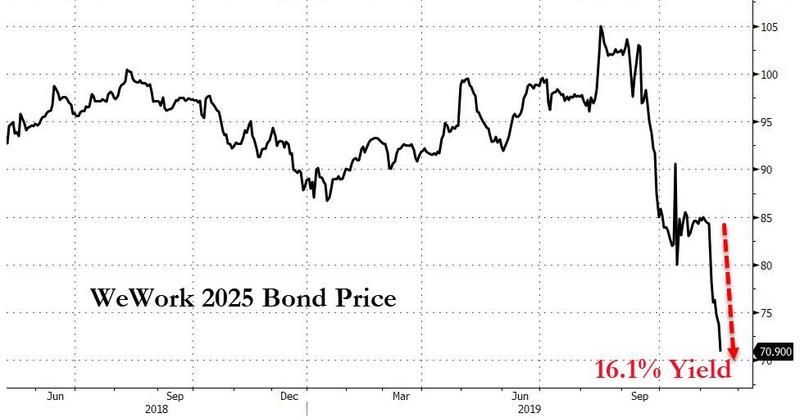

Amid the furor, WeWork's bonds have continued their slide to ever-lower lows.

After using his tremendous salesmanship abilities to sell WeWork as more than just a real-estate company, it looked like Neumann would get away with the outrageous swindle that was WeWork. But after taking SoftBank's Masayoshi Son for another $2 billion, it looked like Neumann had pressed his luck: nobody can be that blatant and not trigger an investigation.

Meanwhile, WeWork's social media accounts are laying it on thick:

https://twitter.com/WeWork/status/1196541192172920833

Read more at: ZeroHedge.com

Please contact us for more information.