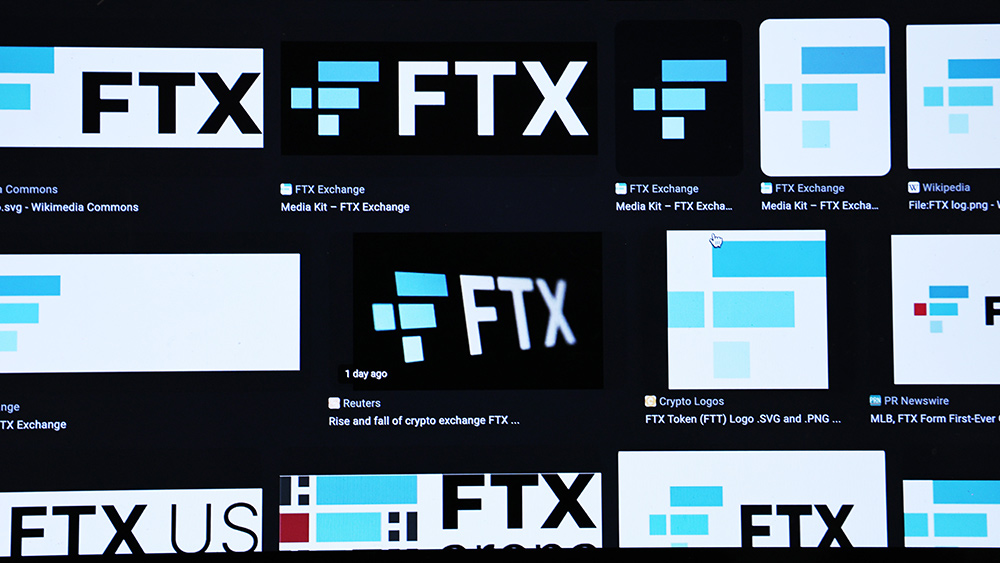

The Feds have launched a massive criminal probe into cryptocurrency futures, which many believe are being rigged by bad apples with the savvy to manipulate prices in their favor.

The Department of Justice (DoJ) is attempting to gain insight into illegal practices taking place in crypto markets and how to curb them. Whether it's "spoofing" the system or flooding the market with fake buy and sell orders in order to lure other traders into the mix, the DoJ wants to know about it.

That's because millions of people around the world who know too little about how crypto spaces work are, at least in some cases, pouring their life savings into these investments. And when they don't pan out, these gullible individuals are ending up with nothing.

With the help of the Commodity Futures Trading Commission (CFTC), a financial regulator that oversees derivatives tied to Bitcoin, the DoJ is said to be conducting its investigation with the hope of improving the integrity of crypto platforms, which increasingly face skepticism for being "Wild West" free-for-alls where the winners are simply the biggest cheaters.

News of the investigation sent Bitcoin's price plummeting down three percent to below $7,500 earlier in the week – this, after reaching an all-time high of around $20,000 back in late 2017.

For more news on the questionable future of Bitcoin and other similar cryptocurrencies, visit BitRaped.com.

Cryptocurrency "bulls" see DoJ investigation as a good thing for cryptos

But this is all a good thing, according to former hedge fund manager Mike Novogratz, who believes that such a probe is long overdue – and desperately needed in order to stabilize the crypto markets and reinforce their legitimacy.

"Weeding out the bad actors is a good thing, not a bad thing for the health of the market," Novogratz is quoted as saying by CCN.com.

"Plenty of exchanges have these inflated volume numbers to create some sense of excitement around coins."

Other cryptocurrency "bulls" and fellow exchange gurus seem to agree, including Cameron Winklevoss, co-founder of Gemini. He told CCN.com that he fully welcomes with open arms "any inquiry that serves to foster rules-based marketplaces and deter bad actors."

Tom Lee, founder of Fundstrat Global Advisors, holds similar beliefs, having referred to the DoJ's involvement as bringing necessary "adult supervision" to the world of cryptocurrency.

With better protections for investors in place, Lee and others remain hopeful that Bitcoin in particular will bounce back from a multi-month lull, and eventually reach $25,000 before the end of the year.

Beware: Many cryptocurrency trading platforms still aren't registered with the CFTC or SEC

At the same time, traders still need to be smart in order to avoid being ripped off. Not only is it important to know about cryptocurrency itself before investing in it, but also about the various platforms on which it's traded.

Since CFTC is only in charge of watching derivatives, it doesn't monitor the spot market for digital tokens. And according to reports, many trading platforms remain unregistered with either the CFTC or the SEC – which means there are no protections in place for everyday investors. The CFTC can, however, impose sanctions on trading platforms that show evidence of fraud.

Unless this "buyer beware" approach to regulatory oversight changes, it's unlikely that the crypto markets will continue to grow, as there's just too much risk and far too many unknowns. But should this DoJ probe clean things up, this could all change for the better.

Companies like Gemini that have voluntarily hired on watchdogs like Nasdaq to surveil daily trading to look for potentially fraudulent,trading patterns are also contributing to improvements in the crypto markets, which will ultimately make them safer and more reliable places for investors to trade.

Sources for this article include:

Please contact us for more information.