Advertisement

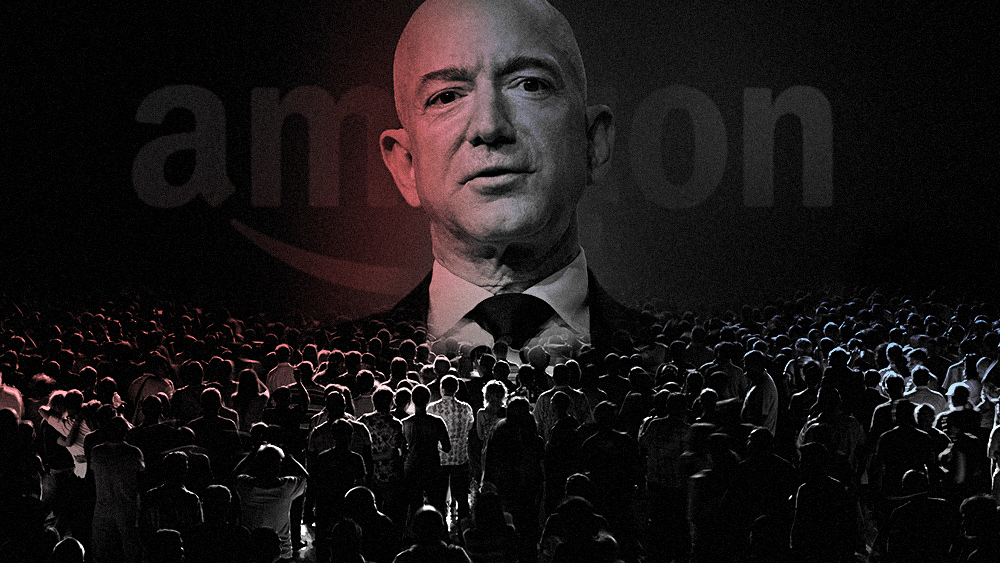

Amazon may be using its position as one of the largest online retailers to unfairly push its own products over those of third-party sellers on its system, according to a new report.

A ProPublica investigation reveals that the online giant has begun positioning its own private-label items on the premiere, top-left slot on Amazon listing where previously, third-party Amazon sellers could big to take that spot.

Amazon products being pushed over those of third-party sellers

Though customers may not have known about it, for years, third-party sellers have been able to bid on search terms to secure the most viable listing positions at the top of Amazon’s product search results pages, where their products would be tagged as “sponsored.”

Consultant Jason Boyce’s clients, who sell natural supplements on the site, were one such seller, bidding as around $6 per item to get on to the premiere slot, or at the very least, on the top row.

Since March, however, Boyce noticed that Amazon’s own brand, Solimo, had taken over the top left slot; as a consequence, his clients’ products ended up being bumped down to a lower row.

Upon further investigation, Boyce discovered that this preferential treatment wasn’t just reserved for Solimo either. Other Amazon brands, such as AmazonFresh Colombia ground coffee, had also been pushed onto the top left spot.

According to Tim Hughes, a consultant who used to work in product management at Amazon, the new approach violates the company’s mantra that every decision must put the customer first.

“Why would their brand be a better option for consumers?” said Hughes, who now works for a firm that helps brands manage Amazon accounts. “It doesn’t necessarily have to be cheaper, or better, or anything. So then what’s their justification to say, ‘We’re just going to put this up in front of everybody else’?”

“This is just another example of Amazon being able to manipulate the platform for its own good use,” he added.

Rush to take advantage of boom in online sales raises antitrust concerns

Both consultants and legal experts said that this new approach looks to take advantage of the surge in online purchases brought about by lockdown restrictions during the Wuhan coronavirus pandemic. (Related: Amazon sued for price gouging during coronavirus pandemic.)

In April, Amazon reported that its revenue rose by 26 percent from a year earlier, boosted by people the increasing number of homebound people making their purchases online. This resulted in a 30 percent increase in the company’s share price, though it did miss earnings estimates for the quarter due to higher costs.

The move, however, could accentuate antitrust concerns, especially with Amazon already juggling probes both in the U.S. and abroad.

The company’s dedicating of prime positions to its own brands could be viewed as “exclusionary conduct” under U.S. law. According to Christopher Sagers, a professor of antitrust law at Cleveland State University, this is one of the key elements of antitrust cases, alongside proving a company has substantial market power.

“If I were their lawyer, this would definitely make me nervous,” Sagers said. “It’s hard to explain the search results finagling as anything besides a nasty, anti-competitive move.”

Amazon has put its interest over those of third-party sellers before

This isn’t the first time Amazon has gotten in trouble over practices that disadvantaged third-party sellers. In March, the company was hit with antitrust claims in a Seattle court that alleged that it had a pricing scheme that “broadly and anti-competitively impacts virtually all products offered for sale in the U.S. retail e-commerce market.”

The suit accused Amazon of continuing to enforce de facto “most favored nation” pricing terms against third-party sellers, despite telling the Federal Trade Commission (FTC) that it would stop doing so. When it abandoned the policy, Amazon was supposed to allow third-party sellers to offer lower prices in competing platforms. However, the company allegedly reframed the same rule as a requirement of its “fair pricing” agreements with third-party sellers, preventing them from having lower prices on other sites.

With Amazon’s dominance in the online retail space, its policies affect the ability of these third-party sellers to conduct business. More importantly, its actions show that its willing to take advantage of this dominant position to increase its own market share, even at the cost of the sellers who also rely on it.

Sources include:

Advertisement

Advertisements